Introduction

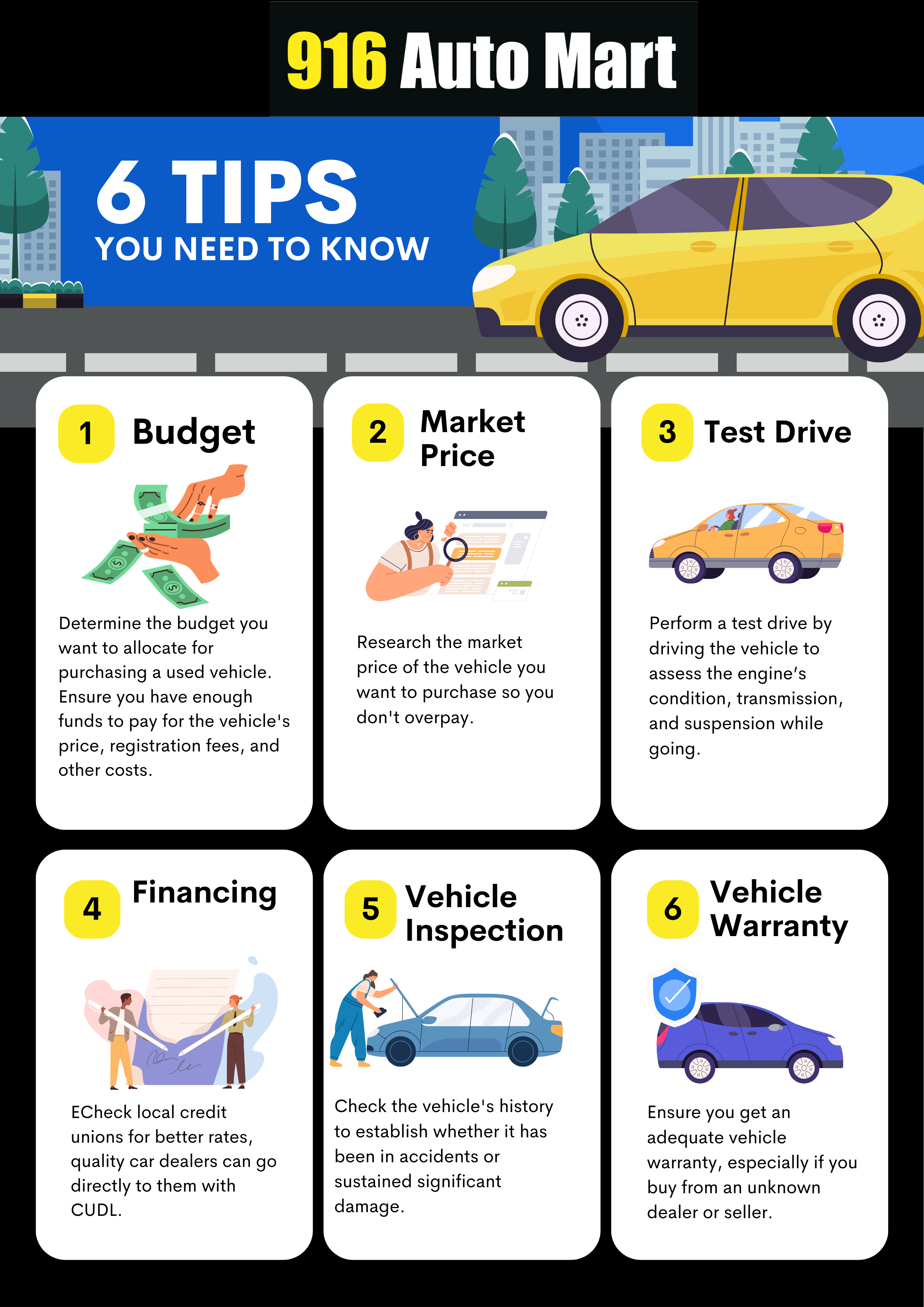

At 916 Auto Mart, we know that buying a used car for the first time can be an exciting yet daunting experience. With the myriad of options available and the potential pitfalls, being well-informed is crucial to making a smart purchase. This guide aims to simplify the process by providing the Top 6 Tips for First-Time Used Car Buyers in Sacramento. By following these tips, you can save money, avoid common mistakes, and drive away with confidence in your new vehicle.

Tip 1: Determine Your Budget

Understanding Your Financial Situation

Before you start browsing the lot or online listings, it’s essential to have a clear understanding of your financial situation. Assess your current income, expenses, and any existing debt. This will help you determine how much you can realistically afford to spend on a car without stretching your finances too thin.

Setting a Realistic Budget

Setting a budget is one of the most critical steps in the car-buying process. It’s easy to get carried away by shiny exteriors and powerful engines, but sticking to a budget will help you avoid financial stress later on.

Tools and Resources for Budgeting:

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), and PocketGuard can help you track your income and expenses.

- Financial Planners: Consulting with a financial planner can provide a detailed and personalized budget plan.

Considerations for Setting a Budget:

- Monthly Loan Payments: Ideally, your monthly car payment should not exceed 20% of your monthly take-home pay.

- Insurance Costs: Research insurance premiums for the models you’re considering.

- Maintenance and Repairs: Factor in potential maintenance costs and repairs, which can vary significantly by make and model.

- Taxes and Registration: Don’t forget to include state taxes and registration fees in your budget.

Considering Additional Costs

Beyond the purchase price, owning a car involves several ongoing costs. These additional expenses can add up, so it’s crucial to consider them when setting your budget.

Additional Costs to Consider:

- Insurance: Get quotes from multiple providers to understand the insurance cost for different models.

- Maintenance: Regular maintenance (oil changes, tire rotations) and unexpected repairs.

- Fuel: Calculate the average fuel cost based on the car’s fuel efficiency and your driving habits.

- Registration and Taxes: State registration fees and taxes can vary, so check the rates in Sacramento.

Example: If your monthly income is $4,000 and your expenses (including rent, utilities, groceries, etc.) are $3,000, you have $1,000 left. Aim to keep your car payment, insurance, and other car-related expenses within $600 to $700 to maintain a comfortable financial buffer.

Tip 2: Research the Market

Identifying Reliable Car Models

One of the keys to a successful used car purchase is choosing a reliable model. Start by researching which makes and models are known for their longevity and low maintenance costs. Reliable cars can save you money and headaches in the long run.

Resources for Car Reviews and Reliability Ratings:

- Consumer Reports: Offers comprehensive reviews and reliability ratings for various car models.

- Edmunds: Provides detailed car reviews, including pros and cons of each model.

- Kelley Blue Book: Offers insights into the reliability and value of used cars.

Top Reliable Used Car Models:

- Honda Civic: Known for its reliability, fuel efficiency, and low maintenance costs.

- Toyota Corolla: Offers excellent reliability and longevity.

- Subaru Outback: Great for those needing more space and off-road capability without sacrificing reliability.

Understanding Market Prices

Knowing the fair market value of the car you want to buy is crucial to avoid overpaying. Use online tools to check the average prices for the specific make, model, and year in Sacramento.

Tools for Checking Market Prices:

- Kelley Blue Book: Provides a comprehensive guide to car values based on condition, mileage, and location.

- Edmunds True Market Value (TMV): Offers a detailed estimate of what others are paying for the same car in your area.

- NADA Guides: Another reliable resource for determining car values.

Example: According to Kelley Blue Book, a 2017 Honda Civic with 30,000 miles in good condition typically ranges from $15,000 to $18,000 in Sacramento.

Checking Vehicle History Reports

Before finalizing any purchase, it’s essential to check the vehicle’s history report. This report provides valuable information about the car’s past, including any accidents, title issues, or previous ownership details. Quality dealerships, like 916 Auto Mart, will provide these free of charge.

How to Obtain and Interpret Vehicle History Reports:

- Carfax: Offers detailed reports including accident history, service records, and previous ownership.

- AutoCheck: Provides similar information and a vehicle score to assess the car’s condition.

- VINCheck: Free service from the National Insurance Crime Bureau to check if the car has been reported as stolen or salvaged.

Key Factors to Look for in a Vehicle History Report:

- Accident History: Avoid cars with a history of major accidents.

- Service Records: Regular maintenance records indicate a well-maintained vehicle.

- Title Status: Ensure the car has a clean title with no liens or salvage history.

Tip 3: Test Drive the Vehicle

Importance of Test Driving

Test driving is a crucial step in the car-buying process. It allows you to assess the car’s performance, comfort, and overall condition. A thorough test drive can reveal potential issues that might not be evident from a visual inspection alone.

How to Conduct a Thorough Test Drive

To make the most out of your test drive, plan a route that includes various driving conditions such as city streets, highways, and rough roads. This will give you a comprehensive understanding of how the car performs in different environments.

Checklist for a Thorough Test Drive:

- Engine Performance: Check for smooth acceleration and any unusual noises.

- Braking: Test the brakes for responsiveness and listen for any grinding or squeaking sounds.

- Handling and Suspension: Assess how the car handles corners and rough roads, and check for any rattling or bouncing.

- Comfort: Evaluate the comfort of the seats, the ease of adjusting them, and the functionality of the climate control system.

- Visibility: Ensure you have good visibility from all angles and that there are no significant blind spots.

- Interior Features: Test all the electronics, including the infotainment system, lights, wipers, and other controls.

Questions to Ask Dealers

While test driving is important, asking the right questions at the dealership is equally crucial. Don’t hesitate to inquire about the car’s history, condition, and any warranties or guarantees offered.

Important Questions to Ask:

- Vehicle History: “Can you provide a detailed vehicle history report?”

- Condition: “Has the car undergone a recent inspection? Are there any known issues?”

- Warranty: “Is there a warranty included with the purchase? What does it cover?”

- Previous Ownership: “How many previous owners has the car had?”

- Accidents: “Has the car been involved in any accidents?”

- Repairs: “Have any major repairs been done on the car?”

Pro Tip: Take notes during your visit and ask for documentation to verify the answers provided by the dealer.

Tip 4: Understand Financing Options

Exploring Different Financing Sources

Understanding your financing options is crucial to getting the best deal on your used car purchase. Various sources offer car loans, including banks, credit unions, dealerships, and online lenders. Each has its own advantages and drawbacks.

Financing Sources:

- Banks: Typically offer higher interest rates, and may have stricter approval criteria.

- Credit Unions: Often provide lower interest rates and personalized service, but you need to be a member.

- Dealership Financing: Convenient and can compare approvals from banks, independent lenders and credit unions. Always compare offers.

- Online Lenders: Quick approval process and the ability to compare multiple offers at once, may have issues with subprime approvals.

Pros and Cons of Each Source:

- Banks: Higher rates unless you have perfect credit, will require higher credit scores.

- Credit Unions: Lower rates and better terms for members, but membership is required.

- Dealerships: Convenient and flexible, typically the lowest rates but not as much control as having a pre approval.

- Online Lenders: Fast and easy application process, but can sometimes have hidden fees and no options for sub-prime.

Getting Pre-Approved for a Loan

Getting pre-approved for a car loan can give you a significant advantage when shopping for a used car. It shows dealers that you are a serious buyer and gives you a clear idea of your budget.

Benefits of Pre-Approval:

- Better Negotiation Power: Dealers are more likely to take you seriously.

- Clear Budget: Knowing your loan amount helps you stick to your budget.

- Saves Time: Streamlines the buying process by reducing time spent on financing paperwork at the dealership.

Steps to Obtain Pre-Approval:

- Check Your Credit Score: Ensure your credit report is accurate.

- Research Lenders: Compare rates and terms from various lenders.

- Gather Documents: Prepare documents such as proof of income, ID, and address verification.

- Apply: Submit your application online or in-person with your chosen lender.

- Review Offers: Compare the pre-approval offers and choose the best one.

Example: According to Experian, pre-approved buyers often secure loans with interest rates 0.5% to 1% lower than those who finance through the dealership directly.

Reading the Fine Print

Understanding the terms and conditions of your loan is critical to avoid any unpleasant surprises down the line. Make sure you read and understand all aspects of the loan agreement before signing.

Key Loan Terms to Understand:

- Interest Rate: The cost of borrowing money, expressed as a percentage.

- Loan Term: The length of time you have to repay the loan, typically 36 to 72 months.

- Monthly Payments: The amount you are required to pay each month.

- Fees and Penalties: Be aware of any late payment fees, prepayment penalties, or other charges.

- Total Cost: The total amount you will pay over the life of the loan, including interest and fees.

Common Terms to Watch Out For:

- Balloon Payments: Large final payments at the end of the loan term.

- Variable Interest Rates: Interest rates that can change over time, affecting your monthly payments.

- Early Payment Penalties: Fees for paying off your loan early.

Pro Tip: If you’re unsure about any terms, ask the lender to clarify or seek advice from a financial advisor.

Tip 5: Inspect the Car Thoroughly

Conducting a Visual Inspection

Before finalizing your purchase, conduct a thorough visual inspection of the car. This can help you identify any potential issues that might not be evident from a test drive alone.

Checklist for Visual Inspection:

- Exterior: Look for rust, dents, scratches, and mismatched paint.

- Tires: Check for even wear and sufficient tread depth.

- Lights: Ensure all lights (headlights, brake lights, indicators) are functioning.

- Interior: Inspect the seats, dashboard, and all controls for signs of wear and tear.

- Under the Hood: Check for leaks, corrosion, and the condition of belts and hoses.

Red Flags to Watch Out For:

- Rust: Especially around the wheel wells and undercarriage.

- Mismatched Paint: Could indicate past accidents and repairs.

- Uneven Tire Wear: May suggest alignment issues or suspension problems.

Example: When inspecting a used car, Jane noticed slight rust around the wheel wells. After discussing it with the dealer, they agreed to address the rust issue before completing the sale.

Getting a Professional Inspection

Even if the car looks good during your visual inspection, it’s always a good idea to have it checked by a professional mechanic. A mechanic can identify issues that might not be visible to the untrained eye.

Benefits of a Professional Inspection:

- Uncover Hidden Issues: Mechanics can spot problems that you might miss.

- Peace of Mind: Knowing the car is in good condition can give you confidence in your purchase.

- Negotiation Leverage: Use the inspection report to negotiate a better price or request repairs.

What to Expect from a Professional Inspection:

- Comprehensive Check: Includes engine, transmission, brakes, suspension, and more.

- Detailed Report: A written report outlining the car’s condition and any recommended repairs.

- Test Drive: Mechanic may perform a test drive to assess the car’s performance.

Pro Tip: Choose a mechanic who is not affiliated with the dealership to ensure an unbiased inspection.

Negotiating Based on Inspection Results

Use the results of your visual and professional inspections to negotiate a better deal. If any issues are identified, you can ask the dealer to fix them or reduce the price accordingly.

How to Negotiate Effectively:

- Be Informed: Use the inspection report as leverage.

- Stay Calm: Approach negotiations calmly and professionally.

- Know Your Limits: Be prepared to walk away if the dealer is unwilling to negotiate fairly.

Example: After a mechanic found that the car needed new brake pads, Tim negotiated with the dealer to either replace the brake pads or reduce the price by $300.

Tip 6: Consider Warranties

Importance of Warranties

Warranties can provide peace of mind and protect you from unexpected repair costs. Understanding the different types of warranties available can help you make an informed decision.

Types of Warranties

There are two main types of warranties to consider when buying a used car: factory warranties and extended warranties.

Factory Warranties:

- What They Cover: Typically cover major components like the engine and transmission.

- Duration: Varies by manufacturer, but usually lasts for a specific number of years or miles.

- Transferability: Some factory warranties are transferable to new owners, adding value to a used car.

Extended Warranties:

- What They Cover: Can cover a wide range of components, including electronics and drivetrain.

- Cost: Usually purchased separately and can be more expensive.

- Providers: Offered by manufacturers, dealerships, or third-party companies.

Evaluating Warranty Options

When considering a warranty, it’s essential to evaluate the coverage details, costs, and terms.

Factors to Consider:

- Coverage: Understand exactly what is covered and what is not.

- Duration: Check the length of the warranty and any mileage limits.

- Cost: Compare the cost of the warranty with potential repair costs.

- Provider Reputation: Research the reputation of the warranty provider to ensure reliable service.

Example: Purchasing an extended warranty from a reputable third-party provider can offer comprehensive coverage for your used car, providing peace of mind for several years.

Negotiating Warranty Terms

You can often negotiate the terms of an extended warranty, especially if you’re purchasing it from the dealership.

Tips for Negotiating Warranties:

- Compare Offers: Get quotes from multiple providers to use as leverage.

- Understand the Terms: Make sure you fully understand the terms and coverage of the warranty.

- Ask for Discounts: Dealerships may offer discounts or incentives for purchasing a warranty.

- Bundle Deals: Sometimes, you can get a better deal if you bundle the warranty with other services or products.

Pro Tip: Always read the fine print and ensure you understand the terms and conditions of the warranty before signing.

Conclusion

Buying a used car for the first time can be a complex process, but by following these top five tips, you can navigate it with confidence. From determining your budget to inspecting the car thoroughly, each step is designed to help you make an informed and smart purchase. Sacramento has a vibrant market for used cars, and being well-prepared will ensure you find the right vehicle at the right price.

Recap of Top 5 Tips for First-Time Used Car Buyers in Sacramento

- Determine Your Budget: Understand your financial situation, set a realistic budget, and consider all additional costs.

- Research the Market: Identify reliable car models, understand market prices, and check vehicle history reports.

- Test Drive the Vehicle: Conduct thorough test drives and ask the right questions at the dealership.

- Understand Financing Options: Explore different financing sources, get pre-approved for a loan, and read the fine print.

- Inspect the Car Thoroughly: Conduct visual inspections, get a professional mechanic’s opinion, and use inspection results for negotiation.

- Consider Warranties: Understand the importance of warranties, evaluate options, and negotiate terms for added peace of mind.

By following these guidelines, you’ll be better equipped to find a used car that meets your needs and budget, ensuring a successful and satisfying purchase experience.

Additional Sections

Frequently Asked Questions (FAQs)

What is the best way to determine my budget for a used car?

- Calculate your monthly income and expenses to see how much you can comfortably afford. Consider using budgeting apps or consulting a financial planner.

How do I know if I’m getting a good deal on a used car?

- Research market prices using tools like Kelley Blue Book and Edmunds. Compare prices at different dealerships and always check the vehicle history report.

What should I look for during a test drive?

- Assess the car’s handling, braking, visibility, and interior comfort. Pay attention to any unusual noises or vibrations.

Can I get a car loan with bad credit?

- Yes, explore options like dealership financing, credit unions, and online lenders. Getting pre-approved and having a larger down payment can improve your chances.

Why is it important to get a professional inspection?

- A professional mechanic can identify hidden issues that might not be apparent during a visual inspection, providing you with valuable information to negotiate a better deal.